Malaysia Budget 2025 Expectations: Addressing the Critical Needs of Data Centres

The data centre space is seeing booming growth across the world over the last 18 months, with the US and Asia Pacific (APAC) leading in terms of processing and power outputs. According to a recent report from commercial real estate services and investment firm, Coldwell Banker Richard Ellis (CBRE), data centre inventory for the US and APAC had seen, respectively, a year-on-year increase of 24.4% and 22%. Similar growth insights have also been reported in the 2024 Global Data Centre Index from DC Byte, with APAC taking the lead with a 19.1% compound annual growth rate (CAGR).

Figure 1: Rapid growth for data centres is now a global trend.

Another market research report, specifically from Jones Lang LaSalle Incorporated (JLL), projected a compound annual growth rate (CAGR) of 7.8% for the overall density of processing racks that are deployed within hyperscale data centres.

By 2027, the average estimate for rack density is expected to reach around 50kilowatts (50KW) per rack, surpassing the current average of 36KW. While the increase in performance throughput is impressive in terms of potential scale, it is quickly becoming a major cause for concern as well when these actual values are translated into energy usage.

As is, the concern of power shortage – alongside water use, lack of a skilled workforce, advanced infrastructure deployment, and extended oversight across various public stakeholders – are now major topics for the data centre sector. These industry issues, which will dominate the narrative for the 5 to 10 years of growth, will be critically impactful to current and future policy-making.

Figure 2: Critical data centre issues to consider.

Powered Concerns

Currently, growing demand for megawatts (MW) and gigawatts (GW) of power have been a major hot-button topic, due to next-gen computing hardware, equally as powerful cooling systems, and connected platforms that these data centres empower across various networks and operational processes.

To set the stage for deeper discussions on this issue, the International Energy Agency (IEA) put out a study in January 2024 that reported how overall electricity consumption is expected to grow at an average of 3.4% from 2024 through 2026.

The report also shared how these gains are powered from various electrification efforts across Asia, specifically China, and the accelerated expansion of the data centre sector. For the IEA, data centres – along with artificial intelligence (AI) and crypto-currency – could potentially double their overall consumption of electricity by 2026.

This massive demand for power, due to the growing surge in data centres being deployed, had pushed Singapore to introduce a moratorium on data centres in 2019. The main driving factor for this move is to better manage the considerable energy consumption from data centres that are coming online in stages. At the time, 7% of its total electricity usage comes from this growth segment of the data and digital economy, with projections putting the anticipated usage at 12% by 2030.

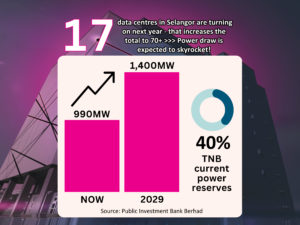

Malaysia is likely to face similar issues as well when multiple data centres start powering up in the coming months. To-date, based on the multiple deployment announcements over the last 18 months, the country will see 17 data centres in Selangor coming online by next year. When added onto the 70 or so data centre sites that are operating around Malaysia, that brings the total to an estimation of 90.

Figure 3: There will be a accelerated growth for energy demands.

All of them will directly contribute to expected jump in power demand, a value that Public Investment Bank Berhad believes will balloon from 990MW to 1,400MW by 2029. The same report, which is an extensive research on the data centre market from July 2024, also noted how the power utilities provider, Tenaga Nasional Berhad (TNB), had received applications from 10 data centres that are requesting for a total energy demand of up to 2,000MW.

Certainly, there is a need for updated regulations that ensure that TNB has enough capacity on the national power grid and will continue to expand its reserves. While reserves are marginally high – at an estimated 40% right now – there must be active strategies that will ensure more is done to ensure long-term sustainability.

Critical focus for energy usage efficiency for the digital growth ecosystem is now a primary focus as current regulations and new policies have put the spotlight on green and renewable energy. These include initiatives that are sustainable and can be ramped up as they are expected to become mainstay focuses for Budget 2025.

Operational Shortages

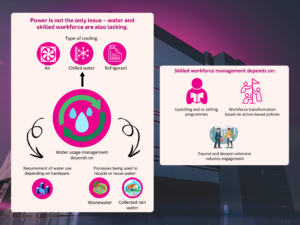

Increased power consumption is not the only concern for data centres. Growing water usage, needing a highly-skilled workforce that has the right skillsets, and deployment of high-tech, high performance infrastructure are also in the spotlight.

Figure 4: Efficient water management and workforce development are key to address these growing concerns.

According to a recent report from The Edge, a typical data centre consumes an average 1.1 million gallons of water per day (4.2 million litres per day – 4.2MLD). While there is the caveat that each data centre will have different levels of usage, it is usually due to their level of operational efficiency. This is mostly due to the precision cooling systems that are being used – this includes air, chilled water, and refrigerant systems that are used to keep the high-performance hardware cool while operating under heavy loads.

The high consumption had even spurred Johor to consider rainwater collection and recycling waste-water processes to be considered for upcoming data centre deployments. The latter is something Amazon Web Services had already implemented for 20 data centre locations.

Beyond water concerns, there need for skilled talent will grow at an accelerated rate as 17 data centres across Malaysia are expected to come online in 2025. In terms of technical skill-sets, deep experiences in project implementation; health and safety; and solution and structural engineering are the permanent flavours of the month since 2020 and it will remain this way until beyond 2030.

Addressing this must go beyond current industry and educational engagements. While there are efforts to educate the next-gen workforce and provide various upskilling and re-skilling programmes for current digital talents, more can be done. This includes initiating policy changes that will focus on digital talent development and drafting new processes that spur workforce transformation.

In doing so, talent development initiatives can be implemented on a shorter time-frame. Critical results from this move include enabling foreign talent trade, fast-tracking knowledge transfer, and empowering public-private collaborations to power programmes that will meet growing demands for a skilled workforce.

While there are many regulatory incentives that power workforce upskilling, re-skilling, and enhancements efforts, as seen in various workforce transformation programmes that have recently appeared, most do not directly align with the current and new requirements of data centres.

Infrastructure Potential

Figure 5: The two major focuses for core network deployment.

Regulations for usage of natural resources and workforce management are not the only policy driven growth drivers for the data centre sector. There are also ecosystem enablers, such as external linkages; network versatility; and continuous growing demand for AI and all things related to AI, machine learning, and automation. Of these, the former is critical as it directly impacts the decision to deploy more data centres as increased network capacity from new submarine cable landings is a huge reassurance to all that there is a long-term view for growth.

The most recent development is the confirmation that two new submarine cable landing stations in Johor that have been proposed for deployment. Both are expected to boost connectivity capabilities for data centres that will be coming online in that state. As is, the need for more submarine cable landings are important as it directly impacts global network latency and overall performance. With the growing demand for data centre deployment in Malaysia – partially due to Singapore’s moratorium that is now lifted partially; the industry-positive policies that are being put in play; and other encouraging factors, such as affordable pricing for energy and water, active engagement to drive forward workforce development, and ongoing rollout of next-gen infrastructure – it is clear that there will be similar explosive growth for submarine cables.

Revisiting and refining the cabotage policy that enable cable-laying ships to install, maintain, and repair submarine cables is a good first step. With interest to install and expand submarine cables in the Asia Pacific and Indo-Pacific regions growing at a rapid rate, this critical infrastructure will be under the spotlight in short order. A report from 2020 in Site Selection reveals how growing demand and, with how the data centre sector is now experiencing booming growths across Southeast Asia, it reinforces the fact that landing points for submarine cables will be a major driving factor as well.

Notably, submarine cables – as a fundamental aspect for data centre and network capacity – will be a major focus point for policy-makers. If more landings are considered and implemented, the eventual benefits include making connectivity pricing more competitive, driving up interest to invest into Malaysia, and boosting the overall robustness of Malaysia’s data centre sector and digital economy.

Policy Innovation

Right now there are ongoing efforts to ensure government policies and supportive regulations are in place are very welcomed. In fact, a new set of guidelines on data centre power and water usage effectiveness, respectively called the PUE and WUE, is expected to be announced in the coming months since it had originally been slated for Q3 2024. According to Senator Tengku Datuk Seri Zafrul Abdul Aziz, Minister of the Malaysia Ministry of Investment, Trade, and Industry (MITI), this move will ensure that the new data centres being built must meet the minimum sustainability requirements.

These new guidelines are being developed and implemented under the guidance of the Standard and Industrial Research Institute of Malaysia (SIRIM) and the Department of Standards. With these new standards, the goal for MITI is to ensure that Malaysia can achieve net-zero emissions by 2050. As such, data centres that are coming online in 2025 must meet the minimum requirements, which global institutions have put in place, to manage their high volume of power and water consumption.

Both units are expected to work closely with the Malaysia Digital Ministry and its agency, the Malaysia Digital Economy Corporation (MDEC), as they push forward various optimisations that will help transform the data centre ecosystem.

Notably, government policies and regulations have long been aligned with the growth of the digital economy. While this is a very welcomed trend, especially since it helped push forward the digitalisation agenda for Malaysia, it also brought to light a major concern – having multiple government stakeholders to work with and manage. Even if it is necessary to engage more than one public sector player, especially when it is related to federal and state government processes, there should be a single entity to manage full oversight of the data centre sector. In doing so, it can properly streamline operational development, processing accountability, and policy optimisation.

Currently, total oversight falls within the jurisdiction of multiple ministries: Economy; Natural Resources and Environmental Sustainability; and Energy Transition and Water Transformation. While each ministry and their respective agencies have a critical role to play, the data centre sector must engage with all of them to understand and meet specific requirements to ensure full governance. This is how standards implementation had to rope in three public agencies.

This need for multi-party engagement is not limited to these specific scenarios as growing the digital economy will require national level policy-making. As is, new government policies and roadmaps that have been launched over the last 18 months, which includes various programmes that are being used to build a roadmap for data centre ecosystem regulation; Malaysia Digital Economy Blueprint; Roadmap National Industrial Master Plan 2030; National Energy Transition Roadmap; Malaysia Renewable Energy Roadmap; and Artificial Intelligence Roadmap, are all focused on pushing Malaysia into a new era of digital transformation.

However, they are fragmented and under different oversights with their own respective mandates. Beyond the newly introduced Malaysia Data Centre Sustainability Framework, the rest do not directly address or manage the data centre ecosystem. In fact, some quarters have already expressed their concerns on risk factors that the new data centre framework might create.

Figure 6: What new policy and regulatory frameworks should focus on.

Ideally, there should be a single point of authority that can work with the data centre ecosystem to develop and implement new regulatory frameworks. Energy sustainability, water shortage, and workforce development – all of which will be addressed during Budget 2025 – are core issues that data centres contend with as they continue to expand their operational presence in Malaysia.

Notably, while various regulations are being developed and streamlined, a brand-new regulatory framework for data centres is being drafted right now – the Data Centre Planning Guidelines (GPP). Developed wholly through the Town and Country Planning Department (PLANMalaysia), an extension of the Malaysia Ministry of Housing and Local Government, this guideline will focus on the various building plans, implementation of innovations, and management of all related applications for data centre deployment. This draft, once ready to be implemented, might be the first step forward towards a single point of authority and interaction with the data centre ecosystem.

As the digital economy continues to be a major focus for Budget 2025, it is critical that an overarching authority is appointed to oversee this important economic driver and growth agenda.