After Big Tech Rollout in Malaysia and ASEAN, What Comes Next for the Data Centre Sector?

The second-half of 2024 is officially underway and there seems to be no end of new investments and big movements in the data centres. This is especially true for Malaysia after multiple Big Tech players revealed their respective plans over the last 18 months to deploy their data centre region; artificial intelligence (AI) development and deployment hub; and regional cloud infrastructure.

Just like the data centre sector and the necessary growth milestones that it crossed, this blog is the first step for AIMS Data Centre to put itself out there and become a critical voice that provides extensive discourse for current trends and latest happenings within this fast-growth technology segment.

In short, this is the start of AIMS Data Centre deciphering the in-and-out of this transformative economic driver and making sense of it all.

Case in point, let’s start with these new investments into Malaysia’s data centre space. While it reinforced Malaysia’s potential to grow and transform its digital economy at scale, it also revealed how there is so much latent potential and interest for these high-performance platforms.

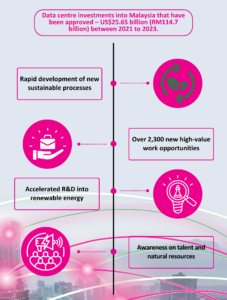

According to Malaysia’s national newswire, Bernama, an estimated US$25.65 billion (RM114.7 billion) had been approved for investments into data centre and cloud services deployment between 2021 and 2023. This resulted in the creation of over 2,300 new high-value work opportunities and acceleration research and development into renewable resources and sustainable processes. This is also reiterated in a report from ASEAN Briefing where it projected that Malaysia would see a compound annual growth rate of close to 14% from 2023 to 2029 with trajectories being set at US$3.97 billion by 2029 – a massive increase from US$1.81 billion value of 2023.

While these critical growth numbers will push Malaysia’s digital economy to greater heights, they also raised very pertinent points of concern; specifically, the sourcing of skilled talents; potential shortage of power and water; and overall readiness of current infrastructure.

Figure 1: Data centre investments in Malaysia (2021-2023).

Impact Assessment

Malaysia cannot afford to brush aside these critical industry concerns. As they have been widely reported and discussed on various press platforms and social channels, these issues do have considerable weight, specifically in how they directly impact current growth rates of data centres and future deployments.

Notably, beyond the landmark announcements from Big Tech, which generated all the subsequent excitement that comes with these major investments, new levels of awareness on the impact of data centre deployment have also cropped up.

Taking into consideration that most would have some level of understanding towards the growing trend that is environment, sustainability, and governance (ESG), let’s dive right into how there are growing concerns that natural resources, like power and water, are limited and not enough for future data centre operations.

In Malaysia’s case, reports have confirmed that Malaysia’s current power reserve margin is at the estimated 40% range and is more than adequate to meet current and new power draws. However, this does not mean that the nation is ready. Once the new data centres come online in the next five to 10 years, an estimated 1,400 megawatts (MW) of power, or even more, is required.

Figure 2: Malaysia’s data centre growth faces critical challenges, including power and water resource management.

This is the primary reason Singapore put in place a moratorium on data centres. Even with its lifting in 2022, there are still many restrictions that Singapore enforces for hyperscalers and cloud data centres to ensure energy and water demands do not overtake current and future outputs.

As there are multiple discourses within the tech industry on energy sustainability, general concerns of environmental impact, and how ESG trends can play a critical part to address these concerns, it’s now more critical than ever that the spotlight must shine onto ongoing efforts to develop and deploy renewable energy and green energy sources.

Reinforcing Growth

For the record, Singapore had been clear on how, since the start of the moratorium on data centre deployment in 2019, it wanted to better manage energy consumption and optimise its land use. This encouraged global and regional hyper-scalers and large-size data centre operators to act on their best interests and look northwards for new opportunities that encourage higher capacity rollouts.

With the lifting of its data centre moratorium in 2022, Singapore quickly approved the deployment of 300MW capacitiy data centres being allowed to deploy. Even so, the momentum to deploy data centres into other countries, specifically Malaysia and Thailand, had grown considerably.

Figure 3: The multiple waves of electronics and digital players that opened up a manufacturing presence in Malaysia over the years.

This remarkably large push from Big Tech into Malaysia is not new, as it feels very much like the hey-days of the electronics manufacturing boom, when the likes of Intel, Motorola, Western Digital, Sony, and Panasonic opened massive factories across Peninsular Malaysia.

Likewise, the growing demand for data – from powering generative artificial intelligence (GenAI); higher awareness for the importance of data management and its impact on the decision-making process; and growing demand for improved cyber-security and data protection measures – is now driving the take-up for data centre stacks and processing racks.

As various industries begin to be caught up with being technology-first centric or realigning to be more digitally focused, data centres have become the primary enabler for digital transformation. Notably, this big push into Malaysia is not a quick fad as Moody’s Ratings reported that the expected growth potential for data centre within the Asia Pacific will rapidly expand over the next five years. Based on the latest data centre report from Arizton, forecasted from 2024 to 2029, Malaysia will scale towards having the largest processing and output capacity for data centres in Southeast Asia.

Figure 4: Malaysia’s data centre growth is now powered via the rise in demand for AI, data management, and cybersecurity.

Next Steps

Let’s be clear – Malaysia’s data centre sector is not nascent. In fact, it’s been around longer than AIMS and, with these new global investments, will remain active for many years to come. This is certainly a big wake up call for Malaysia and its neighbours across Southeast Asia.

Beyond offering larger land sizes, the need for skilled talents – specifically, those with adequate experience, and having the right infrastructure in place are equally as important. While the latter is now being proactively addressed via supportive policies to expand next-gen mobile networks and high-speed fibre infrastructure, it is simply not sustainable with an emerging workforce.

It’s worth noting that there are sentiments on how new data centres will boost up-skilling and reskilling of digital talents. Even so, it is crucial that the existing workforce must quickly be equipped with current and new capabilities to meet the explosive needs from data centres.

Figure 5: Malaysia’s data centre growth hinges on skilled talent, right infrastructure, supportive policies and sustainable processes.

As for innovation in the data centre, aside from ramping up the physical hardware that powers it all, there are other ways to bring new value to the digital economy and socio-economic development. Take for instance, the new data centre that AIMS recently launched at the end of July 2024 – Bangunan AIMS (KL2), a 7.5MW system offering 20 kilowatts (KW) or more per rack that operates in the heart of Kuala Lumpur (KL). Not only is this new data centre based at the literal door-step of Malaysia’s new central business district, it also offers robust redundancy via direct inter-connection – known as AIMS Campus Cross Connect – with the neighbouring Menara AIMS (KL1).

This concept, and other data centre innovations that have appeared over the last few years, focus on various improvements and developmental milestones. Beyond amplifying workload output and providing up-time guarantee, it also delivers scalable support facilities, such as always-on functionality and resilient connectivity.

While new policies that streamline and optimise the build-up of data centres for Malaysia will be a major focus, there is a need to keep in mind that a single contact point within the government agencies for industry engagement must be considered. This is to ensure that facilitation between the public and private sectors are seamless and effective. At the same time, market players will also need to monitor the growing demand for processing and energy capacity as various businesses – be it local, regional, and global – embrace the advanced capabilities of data centres.

Keeping these points of consideration in mind will ensure Malaysia is fully prepped to be a regional powerhouse for the data centre sector.